Friendly reminder that 1099's are required to be filed by January 31st in most instances. Please read the important information below regarding 1099's. If you would like assistance in completing this process please do not hesitate to contact us.

Who is required to send out 1099s?

As an individual home owner or consumer, you are NOT required to send out a 1099 when you pay someone to serve your individual needs or to perform work at your home for example.

However, if you are a business owner, lender, or manage other people’s money, you are more than likely required to issue a 1099. If you don’t, there are serious penalties and you may even not be entitled to the tax deduction for the expense you incurred. Here are the most common 1099 forms you may encounter:

- 1099-NEC. This is the most common 1099 form issued and the “general rule” is that business owners will now file Form 1099-NEC for each person or business, whom in the course of the payor’s business, paid at least $600 during the year. This payment would have been for services performed by a person or company who IS NOT the payor’s employee. (Instructions to Form 1099-NEC). (There are special rules and exemptions…and much more on this below)

- 1099-MISC. This is the form for other payments over $600 that a payer makes in the course of the payer’s business for things such as rent, prizes, and awards, or “other income payments.” Tthese are all reported on Form 1099-MISC.

- 1099-INT. If you pay interest to investors in a format where you borrow and invest, this is a very important form to file. (This is NOT the 1098 form that indicates the mortgage interest you paid). This is the tax form used to report interest income, paid by all ‘payers’ of interest income to investors or private lenders at year-end (1099-INT Instructions).

- 1099-DIV. This Form is typically used by large banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. If you own and operate a C-Corporation with shareholders, this would be the Form to report payments to those investors (1099-DIV Instructions).

- 1099-R. Again, this is a form generally used by big banks, trust companies, or brokerages. This Form is used to report the distributions of retirement benefits such as pensions and annuities. Also, if you take distributions from a self-directed IRA or 401k, you would receive some type of Form 1099-R. (1099-R Instructions).

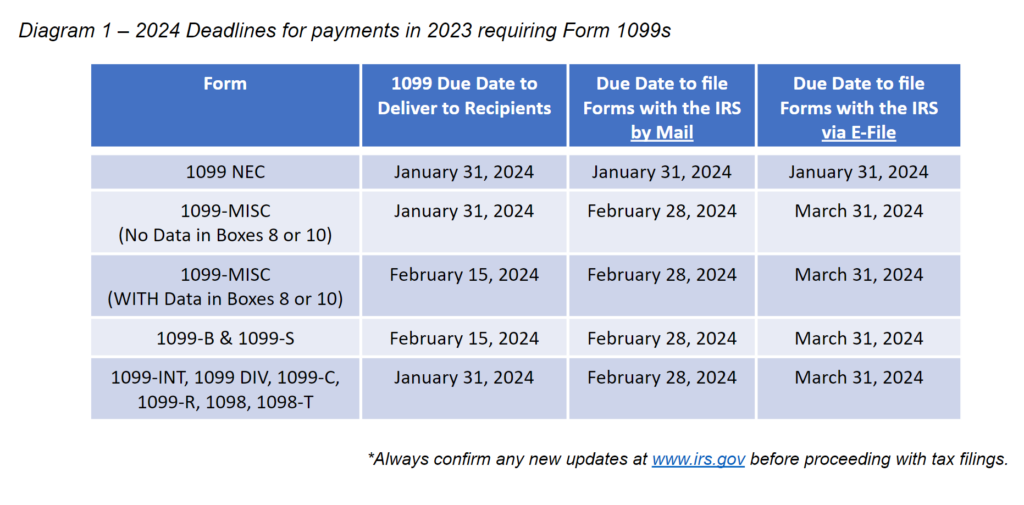

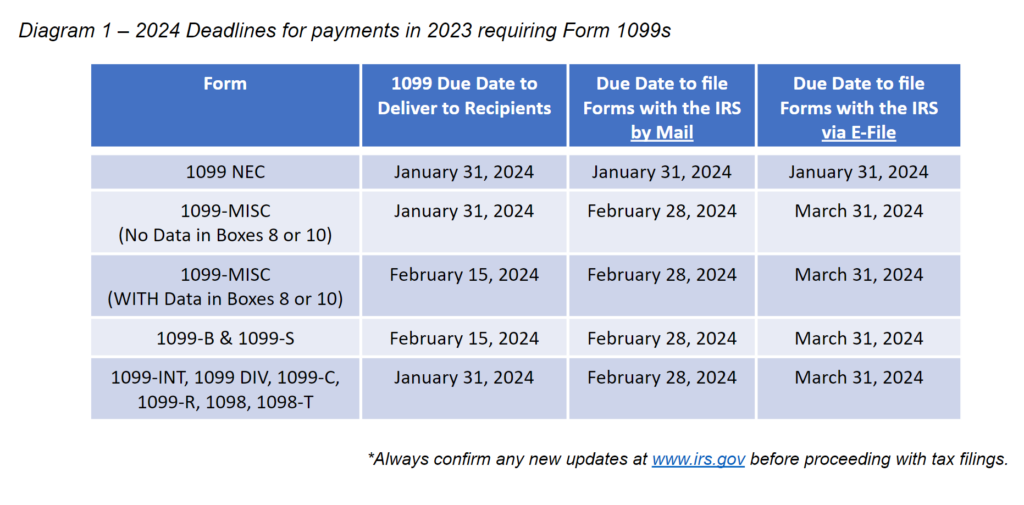

1099 Deadlines in 2024

Business Owner Basics and 1099s

- Who is required to send a Form 1099-NEC? You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than $600. This includes any individual, partnership, Limited Liability Company (LLC), Limited Partnership (LP), or Estate.

- Who are considered Vendors or Sub-Contractors? Essentially, this is a person or company you have paid for services that aren’t an employee.

The W-9 is your “Best Friend”

In this process, it may frustrate some of you that you don’t have all the information you NEED to issue Form 1099-NEC to the payee. One of the smartest procedures a business owner can implement is to request a W-9 from any vendor you expect to pay more than $600 before you pay them.

Getting the W-9 upfront as a normal business practice will give you the vendor’s information you need, including mailing information, any exemption they may fall within, and their tax ID number. For example, the form will also require them to indicate if they are a corporation or not and will save you the headache of sending them a 1099-NEC. You can download a W-9 here.

What are the Penalties if I miss a Deadline?

They vary from $50 to $110 per Form depending on how long past the deadline. Moreover, if the IRS can prove that a business intentionally disregarded the requirement to provide a correct payee statement, they are subject to a minimum penalty of $550 per statement, with no maximum!